Cooperation directly with Visa and Mastercard allows our clients to be more flexible in payment operations

Payment

solutions to

solutions to

boost business

growth

Everything e-merchants and payment service providers need: accept online payments, support multiple currencies, and ensure seamless checkouts & top-tier security.

A unified

payment

dashboard

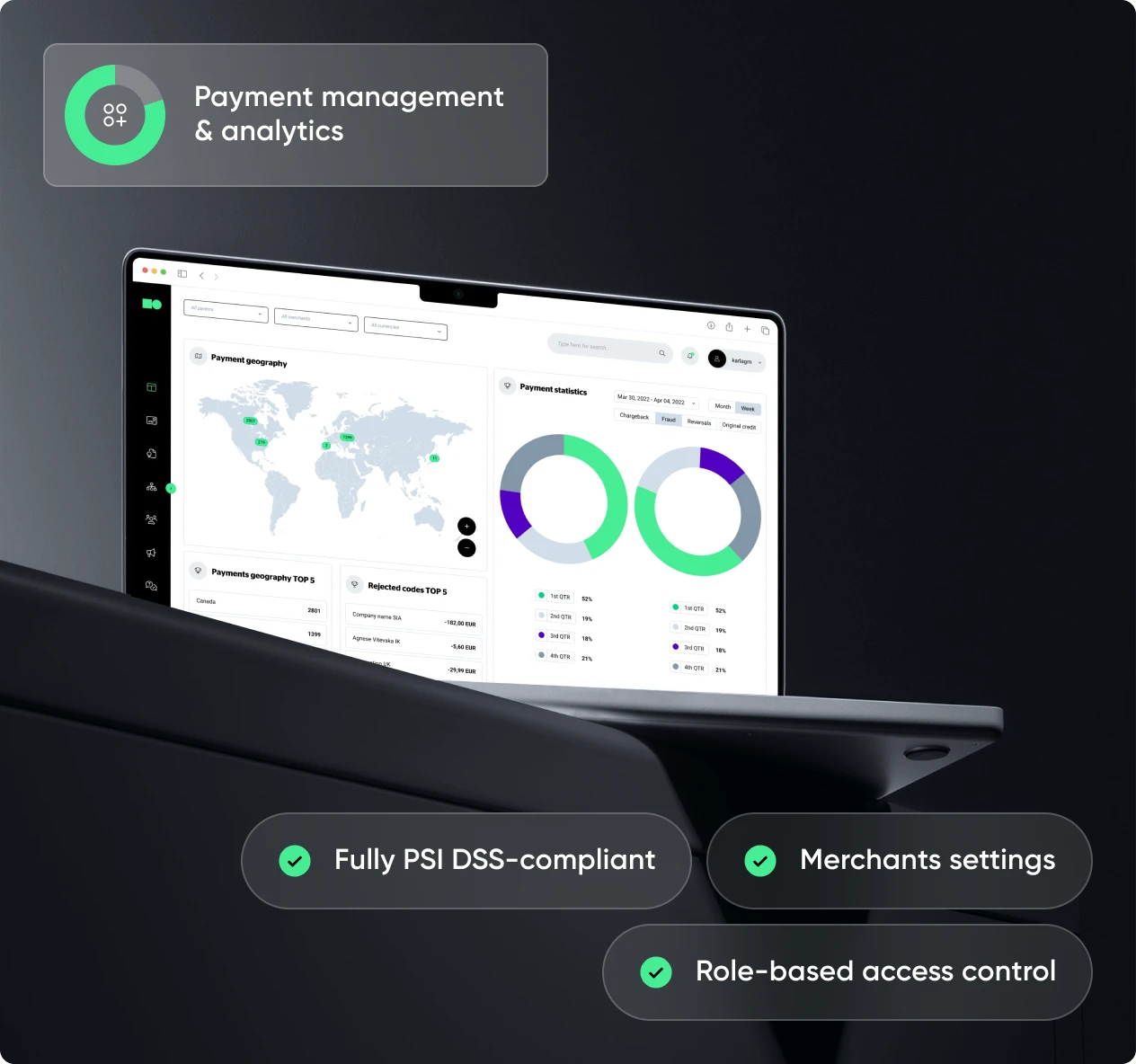

The payment dashboard by Magnetiq Bank bringing clarity and simplicity.

With our user-friendly interface, you can effortlessly manage all your transactions, monitor integrations, handle payments and refunds, and respond to disputes — all in one place.

A better way

to build products

Principal members

16+ years of experience

With 16 years of hands-on experience in e-commerce and fintech, we bring a wealth of practical knowledge to meet your needs

€34.8 M capital & reserves

We maintain sufficient capital reserves to meet regulatory requirements and safeguard our clients’ assets

Associations members

We are participating in the Fintech Latvia Association, Finance Latvia Association, The Latvian Blockchain Association

EU bank fully licensed

We are committed to transparency and excellence and provide seamless banking experiences across the EU

38.76 % capital adequacy

Our commitment to capital adequacy reflects our dedication to risk management and financial stability

Power is to solve

problems together

That’s what we believe in, and our clients usually agree on that

Questions

you may have

What industries do you work with?

We work with various industries, including retail, travel, e-wallets, accommodation, dating, educational services, copywriting, forex, crypto, gambling, rental services, and many more.

What processing currencies do you support?

- We support over 100 currencies, enabling seamless global transactions and helping your business expand internationally.

What settlement currencies do you provide?

We provide settlement in the following currencies: EUR, USD, GBP, PLN, and RON (coming soon).

What payment methods do you support?

We support the following payment methods: credit and debit cards (Visa, Mastercard), Apple Pay, and Google Pay.

What payment types do you support?

We support various payment types, including one-time payments, pre-authorized payments, recurring payments (subscriptions), instalment payments, and one-click payments.