Cooperation directly with Visa and Mastercard allows our clients to be more flexible in payment operations

Bring your

fintech

fintech

brand to life

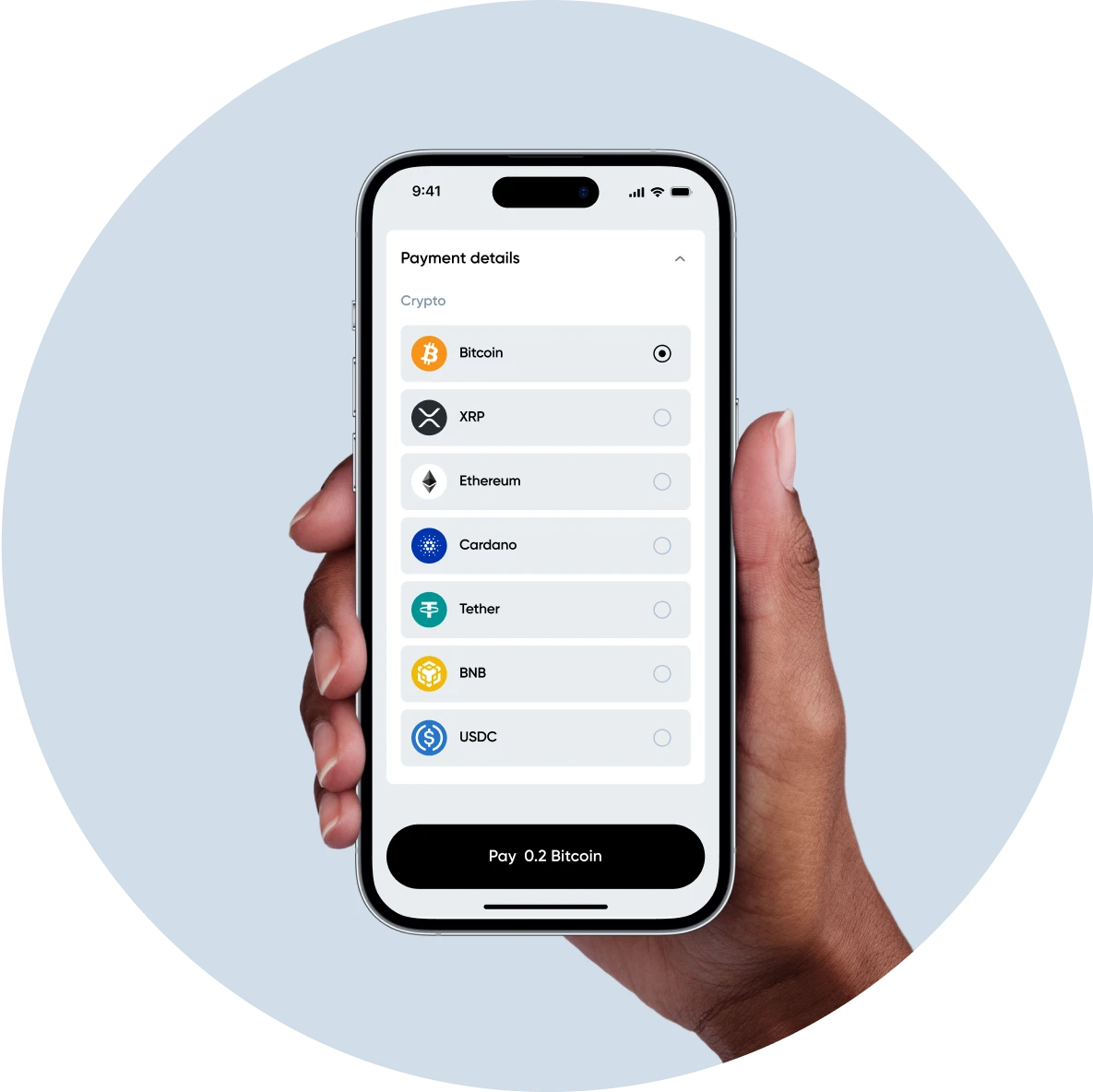

Access our open-architecture payment solutions and a comprehensive suite of banking services designed to expand your fintech business or launch your startup effortlessly.

Security &

compliance first

With Magnetiq Bank, enjoy a BaaS experience that prioritizes

security and regulatory excellence in every transaction

Anti-fraud systems

3D Secure 2

PCI DSS Level 1

PSD2 Conformity

// Create new payment

$response = $api->Payment(array(

'AutoDeposit' => 'true',

'Payment' => array(

'Mode' => 4

),

'Order' => array(

'ID' => 'product_id_' . microtime(),

'Amount' => 100, // In minor units, thus 100 equals 1.00 EUR

'Currency' => 'EUR',

'Description' => 'Test transaction'

),

'Card' => array(

'Number' =>'5186001300001016', // 13-19 digit number

'Name' => 'test', // Under 50 utf8 chars

'Expiry' => '3012', // First year, then month

'CSC' => '999' // Exactly 3 digits

),

'RemoteAddress' => '8.8.8.8' // This MUST be cardholders IP

));

echo "Created new payment:\t\t" . $response->asXML() . PHP_EOL;

// Get payments status

echo "Got status by payments id:\t" . $api->GetPayment(array(

'Payment' => array(

'ID' => $response->Payment->ID

)

))->asXML() . PHP_EOL;

}

catch (SoapFault $ex) {

echo 'SOAP EXCEPTION: ' . $ex->faultcode . ' - ' . $ex->faultstring . PHP_EOL;

}

curl -v -X POST http://127.0.0.1:8010/api/v3/soap \

-H 'Content-Type: text/xml;charset=UTF-8' \

-H 'SOAPAction: urn:GetPayment' \

-d '

<soapenv:Envelope

xmlns:soapenv="http://schemas.xmlsoap.org/soap/envelope/"

xmlns:urn="urn:Gateway"

>

<soapenv:Header/>

<soapenv:Body>

<urn:GetPaymentRequest>

<INTERFACE>3718442</INTERFACE>

<KEY_INDEX>1</KEY_INDEX>

<KEY>xZcu1wHa+itpJAhfMgeQOij7Ow6rFqk75X1pDENdp/IX1ZIuNFWyQIfsj10amhwFlXsQMsJ840dDVCzzk71b5RJeg/+HozTov+droIw2G0jcYrp9kFEhTS+pm+DSD9J+mVtlupsC9a1xsHl4rEeH2sI9HzSjMe+6hBfib82mbOw=</KEY>

<DATA>0ll4YkF8ovO+0ZmxhGn0GDV/RE5A9weWdcjXl8XFMIhlxxVQWazDsSw3ICBCQbcAfysJlWp+og/8wKt+vs2iU7q4x85dnNROgSIb/UixM/bapxukQaVAFJDIuwdrnRnggiz5SWPvm5JmnB29rl3fbkTibVJ2QiY=</DATA>

<SIGNATURE>iQWaErG9kZeCggVTm6FJtSw2ZWqgt0UYw9W+KUIK0qBbZeUaOkyk7b7nGkm+sN6McmVt+ues1eoLNzzp4qKfWnEawkp/6ChyZex687FEs5G8KOw/6gRxqNaGKTaslA6R4j4MEbCz4+2rkHF7y3HGA07N11iEq+lafoe+YfJyEQk=</SIGNATURE>

</urn:GetPaymentRequest>

</soapenv:Body>

</soapenv:Envelope>'

// Create new payment

final PaymentResponse response = api.Payment(new DataType() {{

PaymentType payment = new PaymentType() {{

setMode(4); // SOAP payment, non-3d secure

}};

OrderType order = new OrderType() {{

setID("product_id_" + new Date().getTime()); // Must be unique for every payment

setDescription("Test transaction");

setAmount(100); // In minor units, thus 1.00 EUR

setCurrency("EUR"); // In ISO alpha3 format

}};

CardType card = new CardType() {{

setName("Lorem Ipsum"); // Not longer than 50 chars

setNumber("5444870724493746"); // 13-19 digits

setExpiry("3012"); // Must be in future

setCSC("999"); // 3 digits

}};

setAutoDeposit(true); // Capture right after authorization

setPayment(payment);

setOrder(order);

setCard(card);

setRemoteAddress("8.8.8.8"); // Clients IP address

}});

System.out.println("Created new payment:\t\t" + response);

// Get payments status

final PaymentResponse status = api.GetPayment(new DataType() {{

setPayment(new PaymentType() {{

setID(response.Payment.ID);

setMode(4);

}});

}});

System.out.println("Got status by payments id:\t" + status);

# Create new payment

response = api.Payment({

'AutoDeposit': True,

'Payment': {

'Mode': 4

},

'Order': {

'ID': 'product_id_' + str(time.time()),

'Amount': 100, # In minor units, thus 100 equals 1.00 EUR

'Currency': 'EUR',

'Description': 'Test transaction'

},

'Card': {

'Number': '5186001300001016', # 13-19 digit number

'Name': 'test', # Under 50 utf8 chars

'Expiry': '3012', # First year, then month

'CSC': '999' # Exactly 3 digits

},

'RemoteAddress': '8.8.8.8' # This MUST be cardholders IP

})

print("Created new payment:\t\t", response)

# Get payments status

status = api.GetPayment({

'Payment': {

'ID': response['data']['Payment']['ID']

}

})

print("Got status by payments id:\t", status)

except Exception as ex:

print('SOAP EXCEPTION:', ex)

// Create new payment

let request = {

AutoDeposit: true,

Payment: {

Mode: 4

},

Order: {

ID: 'product_id_' + new Date().getTime(),

Amount: 100,

Currency: 'EUR',

Description: 'Test transaction'

},

Card: {

Number: '5186001300001016',

Name: 'test',

Expiry: '3012',

CSC: '999'

},

RemoteAddress: '8.8.8.8' //Cardholder IP address

};

api.Payment(request, (response) => {

console.log('Created new payment:', response);

api.GetPayment({

Payment: {

ID: response.data.Payment.ID

}

},

(status) => {

console.log('Got status by payments id:', status);

})

});

Start quick integration with our easy API

Spend less time connecting to our API, use banking infrastructure, and grow faster

Connect to the API

A better way

to build products

licensed banking infrastructure

Principal members

16+ years of experience

With 16 years of hands-on experience in e-commerce and fintech, we bring a wealth of practical knowledge to meet your needs

€34.8 M capital & reserves

We maintain sufficient capital reserves to meet regulatory requirements and safeguard our clients’ assets

Associations members

We are participating in the Fintech Latvia Association, Finance Latvia Association, The Latvian Blockchain Association

EU bank fully licensed

We are committed to transparency and excellence and provide seamless banking experiences across the EU

38.76 % capital adequacy

Our commitment to capital adequacy reflects our dedication to risk management and financial stability

Power is to solve

problems together

That’s what we believe in, and our clients usually agree on that

Questions

you may have

What is Banking as a Service (BaaS)?

BaaS is a model that allows non-bank businesses to offer financial services by integrating bank products through APIs. It enables companies to provide banking-like services without becoming a licensed bank.

How BaaS model works?

BaaS allows non-banking businesses to offer financial services through licensed banks. Unlike traditional banking, where only banks provide services, BaaS enables companies—like FinTechs or retailers—to integrate banking features directly into their products. This model opens up new revenue streams for businesses while letting customers enjoy seamless financial solutions, such as payments, loans, and digital wallets, without leaving their favorite platforms. Magnetiq Bank BaaS model supports this integration, offering a flexible and compliant way for businesses to deliver essential banking services.

What do you get with Magnetiq Bank BaaS solution?

Magnetiq Bank BaaS offers customizable banking tools such as payment processing, account management, all accessible through secure APIs.

What is BaaS for?

BaaS is ideal for fintech’s, startups, e-commerce platforms, and companies looking to integrate financial products into their offerings.

What benefits do BaaS providers offer to their clients?

BaaS is ideal for fintech’s, startups, e-commerce platforms, and companies looking to integrate financial products into their offerings.