The realm of payment systems is currently undergoing a revolution, providing businesses with new opportunities to enhance their financial operations, cut costs, and improve the security and efficiency of transactions. In this article, we’ll take a deep dive into three crucial aspects of today’s financial landscape: payment systems, correspondent banks, and the Visa B2B Connect platform. We’ll explore how these technologies and services are reshaping the business world and how financial institutions can take advantage of them.

-

SWIFT: tradition and security in global money transfers

For businesses involved in international money transfers, SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a dependable tool. Linking over 11,000 financial institutions in more than 200 countries, SWIFT provides a global network for money transfers.

In 2023, an average of 44.8 million payments were processed daily, underscoring the essential role of the SWIFT platform in the global financial infrastructure and its reliability for financial institutions worldwide.

-

SEPA: European ease for business

For businesses and Fintech companies in Europe, SEPA (Single Euro Payments Area) is an essential tool for euro payments. SEPA unites 36 countries into a single payment area, enabling money transfers as easily as sending money to a local bank.

According to the European Central Bank, the total number of cashless payments in the Eurozone exceeded 134 billion in 2023.

-

TARGET: big money, fast and secure

For Fintech companies and financial institutions handling large sums of money that require fast and secure payments, the European Central Bank offers the TARGET (Trans-European Automated Real-time Gross Settlement Express Transfer) system.

According to the European Central Bank, the number of payments processed through the TARGET system exceeded 479 million in 2023.

Instant payments: the fastest path to a more efficient business

Instant payments are a faster and more efficient solution for businesses looking to speed up financial operations. With instant payments, transactions can be completed in seconds, regardless of the time of day, ensuring immediate transfer of funds.

According to a report by ACI Worldwide, the number of instant payment transactions in Europe grew from 13.2 billion in 2022 to approximately 17.2 billion in 2023. This figure is expected to continue rising, reaching 38.6 billion by 2028, with a compound annual growth rate (CAGR) of 21%.

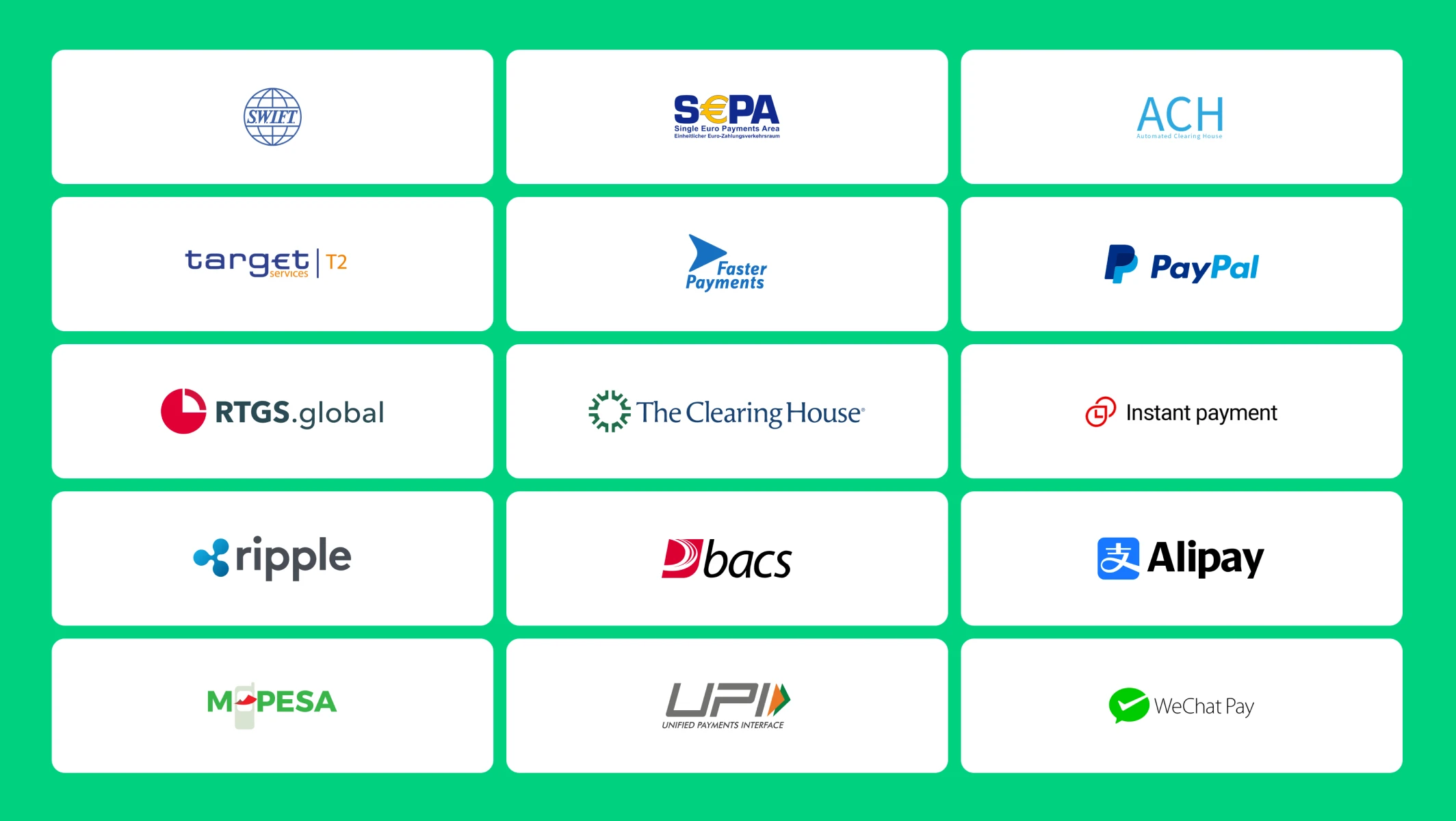

In today’s global market, many other payment systems also offer solutions for efficient business operations:

ACH (Automated Clearing House)– a popular U.S. domestic payment system that provides efficient and secure transfers.Faster Payments– quick and secure payments in the United Kingdom, enabling businesses to make swift transactions.RTGS (Real-Time Gross Settlement)– real-time, high-value transfers available in various countries, ensuring the immediate availability of funds.

Understanding these payment systems helps businesses choose the most suitable solution to ensure fast, secure, and efficient financial transactions, adapting to the demands of different markets and fostering business growth.

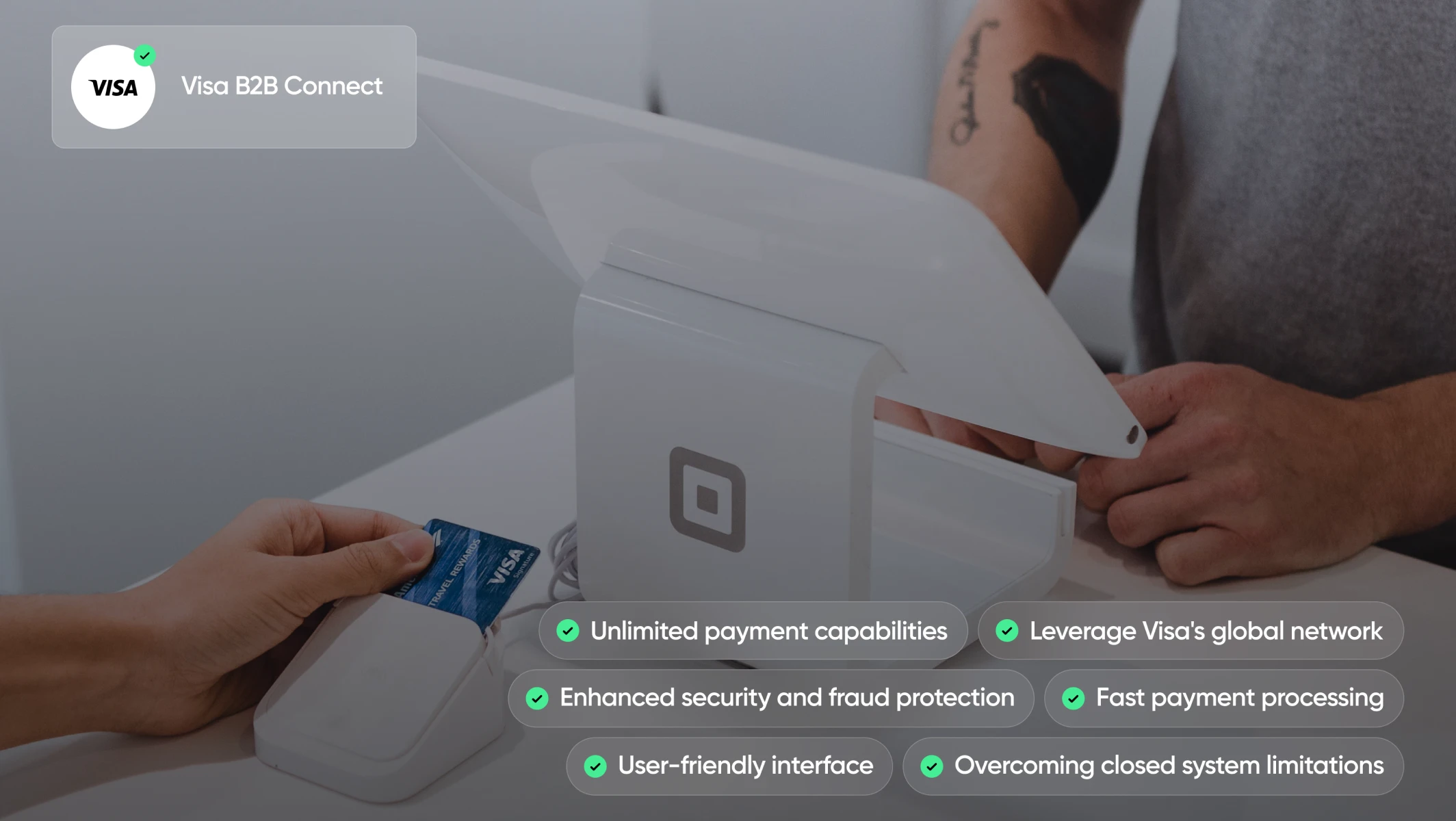

Visa B2B Connect: global B2B payments through a single connection

n the business world, speed and security are crucial, especially for international transactions. Fintech companies are increasingly turning to innovative solutions to optimize their payment processes, and one such solution is the Visa B2B Connect platform. It offers significant advantages in both speed and security by leveraging modern technologies.

Key advantages of Visa B2B Connect:

Unlimited Opportunitiesfor outgoing payments to business partners in over 120 currencies, including GBP and USD.Leverage of Visa’s global network:built on Visa’s extensive global network, the platform offers versatile connectivity, allowing for clear timelines and transparent costs. This enhances predictability and economic efficiency in corporate transactions.Fast payment processing:the platform significantly reduces the time traditionally required for transactions, enabling quicker payment processing.

These features make Visa B2B Connect a powerful tool for businesses seeking to optimize their international payment processes, offering a combination of speed, security, and ease of use.

Banks focused on serving FinTech companies are a crucial component in promoting the development of new and innovative financial services, thereby enhancing financial inclusion and literacy in society.

Tīna LūseManaging Director of the FinTech Latvia Association

Ziņas un blogs

Ziņas un blogs